When I buy stocks, I usually go by what I perceive as intuitive decision-making. Over the past few months, I had been thinking about putting structure and logic into my intuition so I started with a portfolio allocation study of my own portfolio formed by, supposedly, my intuition. Perhaps it is something I subconsciously know about but have not written it out before.

Before I buy, I usually have to answer Yes to a few basic questions:

- Is the business income model sustainable?

- Is the growth driven by legitimate economic demand?

- Is the yield >= 5%?

Assuming Yes to #1 and #2, if the yield is <5%, I will check what the historical yield (10-20 years) is. If the current yield is higher than the historical yield, then it's ok to buy.

The first exercise was to calculate the yield distribution. I currently have a 5% p.a. return. Market value vs. capital is -15% in the current down market. "3-4%" means more than 3 and less than or equal to 4.

|

| My portfolio allocation by yield (based on ~S$200k capital) |

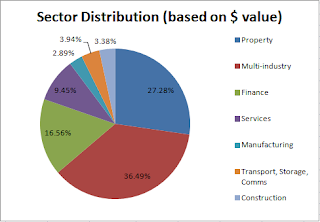

The second exercise was to study the industry/sector the companies are in. The categories follow the SGX sector classification. I favour conglomerates with multiple businesses and property landlords. Having multiple businesses allows the company to more efficiently operate, especially when the businesses are related from a supply-chain perspective. These companies also tend to have passive income (expenses are very low relative to the income earned), which I like a lot.

The third exercise was to study my risk appetite. I usually don't like debt-ridden companies. Ratios I always look at are :

- Debt/Equity ratio (lower the better)

- Enterprise Value/EBITDA (lower the better)

- Receivables (quarter to quarter comparison) this will usually signal whether their customers have problems paying and it's useless (bad debt) if the customers cannot pay up.

Portfolio allocation only makes sense when your capital is at least $50,000. However, it is important to also know what you are building so that you will slowly see your portfolio become the portfolio you have imagined it to be. While I said that I bought based on intuition, I probably took the easy way out to explain how I selected the shares I bought.