The share price for this company had recently fallen a lot, because of fewer projects, reduction in suppliers' rebates (hence increased cost of sales) and increase in marketing expenses that ate into profits.

|

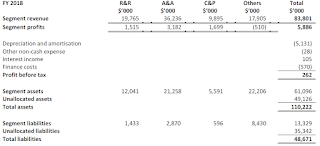

| Extracted from presentation slides from 4Q2018, ending 30 Jun 2018 |

65% of revenue comes from R&R and Additions and Alterations (A&A), which are rather labour-intensive. It's one of those things like a hair cut where you need hair cuts regularly and it can't exactly be automated. For hair cuts, the demand scales proportionally to the population. For R&R and A&A services, the demand scales with the number of buildings, which is correlated with the population and number of businesses. From this aspect, we can expect these services to remain in demand. Barrier to entry isn't high, but due to the labour-intensive nature of these services, new entrants will likely be smaller scale sub-contractors instead.

Nature of Expenses

As they spent $13M on their new corporate office in FY2017, the loans and depreciation expenses have just kicked in in FY18. Personally, I think that centralisation is good, considering that they had acquired many companies in the past few years and they likely had not consolidated their systems and manpower. Whether or not they can integrate everything together fast enough to control their expenses, I do not know, but the expenses do look prudent.

Net profit margin dropped to 0.9% in FY2018. I like it that this number was calculated and presented in the slides. Some companies that want to down play the decrease in net profit margin leave it to you to calculate it from the financial statements and just show you the gross profit margin. It will be good if they had stated how many years they used to depreciate their new leasehold property. It is also unknown if there are any old office premise currently parked under property assets that they will be selling away after they shift to their new office.

|

| Extracted from financial report from 4Q2018, ending 30 Jun 2018, page 27 of 29 |

|

| Extracted from financial report from 4Q2017, ending 30 Jun 2017, page 27 of 29 |

Earnings

Earnings per share is 0.66 cents. Dividend is 0.18 cents. Based on the last transacted price of 24 cents, it translates to Price Earning Ratio (PER) of 36 and Yield or 0.75%. This is awfully low and further price drops should be expected. The number of projects need to increase, or expenses reduced, in order for them to reap profits again.

References:

The writer owns shares in Isoteam.

No comments:

Post a Comment