Over the past 10 months, banks, not just in Singapore, had been battered really badly. I had been buying all three bank stocks, but what should a new buyer be looking out for?

| Bank | Peak | Low | % change |

| DBS | $21.50 | $13.01 | -39.5% |

| OCBC | $10.92 | $7.41 | -32.1% |

| UOB | $25.05 | $17.01 | -32.1% |

1. Debt to Deposit ratio

The loan to deposit ratio is used to calculate a bank's ability to cover withdrawals made by its customers. In Singapore, the Singapore Deposit Insurance Act insures deposits by individuals up to $50,000. This is a safeguard against bank customers, such as you and I, to withdraw our money en masse when the bank shows signs of weakness. For e.g. when you see a headline such as HSBC made a net loss for their full year, as a customer, you may feel worried that your deposits may disappear if the bank goes bankrupt, and hence want to withdraw your money. If many people do that, the deposits outflow will create cash flows problems for the bank, which worsens the bank's financial woes.

A ratio of 1 (100%) means that for every $1 loan given, it is supported with $1 deposit from another customer.

Compared with the US banks, the SG banks' debt to deposit ratio is high (84-89%). Read this recent article about the US banks. As the US banks prepare for the interest rate hike, JP Morgan, the most risk-adversed, maintained a debt to deposit ratio of 60%. There is no magic number, just a risk appetite measurement.

2. Cost to Income ratio

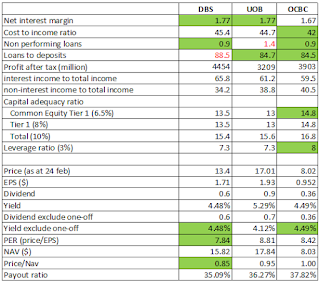

This ratio calculates a bank's expenses as a multiple of its income earning ability -- the lower, the better. Compared with a year ago, all three banks' cost to income ratios had increased.

|

| Extracted from individual financial reports. Distribution of income sources and loan currencies. |

|

| Extracted from individual financial reports. Key financial ratios. |

OCBC appears to be the best positioned out of the three. This confidence is also reflected in its market price where Price/NAV is 1 (i.e. fully valued). Although DBS' Price/NAV is 0.85, it may not be undervalued, as the market had priced in its risks towards non-performing loans in the commodities sector which DBS has the highest exposure to.

Among the three financial reports, the DBS CEO was particularly upbeat about the economy, delivering lots of confidence in the business outlook for even badly battered commodities sector. In fact, they presented the "worst case scenario" where all the commodities debt go bad and they would still be in good shape. In my opinion, based on the sectors with higher absolute amount of non-performing loans, the companies that we need to be wary about are in industries such as manufacturing, transport, logistics, communications. If we have holdings in industrial REITs, where these companies typically operate in, we would need to keep our eyes on the "account receivable" component of the balance sheet to ensure that their tenants are on-time in their rental payments.

Housing loans form a substantial fraction of non-performing loans for UOB. This could be a sign that prices of high-end condominiums will continue to fall because UOB targets this sector of home loans. Consequently, we should also take note of the property developers that are still holding on to vacant units of similar high-end condominium developments. Leasehold units should expect a worse fall based on historical trends.

Buy based on yield, if you can afford to hold for more than five years, the 4.5% yields are very good value for money because in good times, yields hover around 2-3%. If you just have your last $5,000 or less, don't bet on these stocks to make a quick rebound anytime soon.

The writer owns units of DBS, OCBC and UOB shares at the time of writing.

References:

No comments:

Post a Comment