I understand that markets are at times volatile. If my investment portfolio loses 10% of its value, I would:

If I choose Buy more, my risk appetite is assessed to be higher. In most cases, buying more is always a representation of someone who takes high risks. In order of risk appetite, a low risk taker might sell everything.

However, there are two aspects to this. In reality, do these people really buy more or they just choose buy more as a textbook answer? Do they sell everything or hope for prices to recover?

The typical question is about a down trend scenario. Let us now think about an up trend scenario with the same scenario options. My portfolio has increased by 10%, if I buy more, am I a high risk taker?

From my observation, when prices drop by 5%, most people will not buy more, neither will they sell parts or everything. When prices drop by 10%, most will not buy more, instead, some might sell parts or everything. When prices drop by 20%, most will do nothing. When prices increase by 5%, most people will do nothing. When prices increase by 10%, most will sell, especially if prices had been depressed for some time. When prices increase by 20%, more will buy and not sell anything.

Many surveys and friends have classified me as a high risk taker. In theory and in practice, that is what I do:

Down trend of a stock - I buy more

Up trend of a stock - I do nothing most of the time. Sometimes I sell 25% of my stock's volume to rebalance if prices have risen to a price that I feel it's too high.

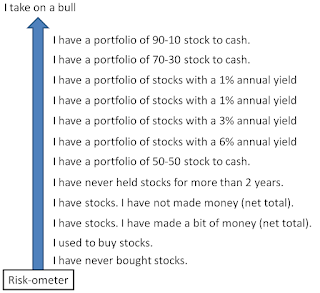

For illustration, between Aug 2015 to Jul 2016, I spent at least 100k buying stocks in a year. I felt poorer and poorer every month because prices continued to fall or remained low. I still remember spending 30k in one particular month. For comparison, I only spent about 20k this year. Everyday I wished that I had more money to buy. I asked my broker to increase my buy quota to 40k because I couldn't submit orders to buy queues. I allocated different budget pots for different price drawdown %, so I was at 70-30 stock to cash allocation when the market was just about -20%. When stock prices started rising, I was relieved because I could finally start saving up again, which shows that I am not that high a risk taker? I see myself taking calculated risks, i.e. I know that I have factored in sufficient margin of safety. I know I had done my best evaluation based on all the known information available when I made the decision. My priority is also income investing because that is a double safety net for me -- a margin from income and a margin from capital gain.

I usually hover around 50-50 stock to cash to feel safe. My financial advisor advises 80-20 investment to cash, investment including ETFs, unit trusts and endowment funds. She said I am taking on more risk by keeping 50% cash. Obviously, we don't have the same definition of risk. Similarly, everybody's definition is slightly different. Hence to really assess the person appetite for risk, maybe that one question is probably a good proxy after all, even if it's just a textbook exercise.

|

| My risk-ometer |