I picked this e-book from the online library (National Library Board - Overdrive) as it was available and I didn't have to deal with a hardcopy book reservation and pick up. It was really convenient to read the e-book.

The book is about an ex-trader who believes that traders deal with random events everyday. The whole book is about his musing about different aspects of randomness that he has noticed in traders and why he didn't agree with them. For example, he believes that the guys who follow trend analysis to buy and sell stocks are simply lucky that they are buying and selling in an uptrend, so anybody would have made money. And these guys will be so convinced that they have the skills to analyse trends that they convince themselves that once in a while, when there are unexpected/unpredictable events, they will be "wrong", and find some excuse to convince themselves that they are still right.

It made me reflect about the way rewards are structured in a fund house. Outcomes are favoured and many times, outcomes can't really be controlled too. One fund manager may be luckier and gets a 20% return, whereas another fund manager may be less lucky and gets a 2% return. On paper, the one with the 20% is better. There may be also other funds with -20% return, that will never be on the recommendation list to customers until it yields a positive return. When customers look for fund managers, they only look for those with high returns, and they ignore everything else because returns are all that counts. While there may be some truth behind position sizing, asset allocation, diversification strategy, risk assessments, if we think about it logically, it boils down to fundamental analysis, i.e. whether or not there is an income-generating element. It amazes me how some people can convince themselves to part with their money and trust fund managers that do not even disclose the underlying assets. What if they are just buying a bunch of lottery tickets?

If you would like an alternative take to looking at stock markets, this is a really good book because it introduces the concept of probability, and after reading it, I am quite sure that you even doubt fundamental analysis. The authors suggests that you have nothing certain, which is true, you don't know what will happen tomorrow, and although probability of these unpredictable events are low, the impact can be very high to wipe out everything. Thinking about how some companies become bankrupt is a good example, despite what people say about the fault lying in poor financial management and all, there are many companies with poor or worse financial management too, yet they survive, so there is really no way to tell when these companies will go bankrupt.

Survivorship bias is another topic that really resonated with me because it am always told to follow "tried and tested methods", follow that the boss says, etc. What worked in the past may not always work in the future. While there is a low probability of the "may not work in the future" event happening, the impact, if of the event can be very severe, for example, you may not have enough time to change a system, may not have enough time to raise money to do certain things you need to do, etc. Always thinking and assessing every situation, no matter how routine, is essential.

Buying with probability of events in mind will certainly help factor in margin of safety, which is the principle preached by Graham. As a whole, the author advocates being conscious about randomness, so that we don't become overly complacent, we don't think get controlled by emotions, we are mindful when luck plays a part, we don't show-off, we make decisions with more awareness of possible outcomes to set realistic expectations so that we don't get crushed by black swan events. I am certainly heading to his next book The Black Swan next.

Monday, November 26, 2018

Friday, November 16, 2018

How much have I earned and lost in 2018?

How much have I earned and lost in 2017?

I am writing this earlier this year as the total amount should be more or less the same by year end. Objective for 2018: Increase REITs by 10%, increase portfolio yield by 0.5%, increase income to $14,000.

Verdict: Didn't meet, didn't meet, meet.

Average dividend yield in 2017 was 4.56%. I didn't meet my target, and my average yield was 4.73% this year. This was achieved by buying stocks with >5% yield to increase the average, but it got pulled down by other non-performing stocks that cut dividends. In 2017, the plan was to support the increase by increasing REITs to 50% of my portfolio, starting from REIT ratio of 23% in 2017, and slowly rebalancing and capital injection at the right prices over 3 years, from 23% -> 33% -> 43% -> 50%. I did not buy that many REITs. In fact, I bought Singtel instead because yields were more attractive than REIT yields.

In order to further increase the average yield by another 0.5% will not be as easy as it will require buying stocks with >6% yield to increase the average. I may want to increase the growth stocks proportion, but I will see how prices are next year.

Income was $15,500 ($1,290/month), so I exceeded the target of $14,000. The additional increase was due to better dividends and also high bank interest rates from Bank of China 2.75%, UOB One 2.43%, Hong Leong Finance 1.7%, CIMB Fastsaver 1%, Singapore Savings Bonds 1.8%.

I didn't increase my Autowealth portfolio much as I found the prices too eratic. I will continue to contribute $400/month after the prices reverse closer to the mean. After an insane annualised yield of 15% in 2017, in 2018, the returns are a mere 4%, and could have been lower if I had continued to contribute as prices escalated 2% per month only to watch a big fall a few months later.

Unrealised profits/losses:

Autowealth = S$50 (+$260 in 2017)

Singapore Stocks = -$20,000 (+$20,000 in 2017)

Overall, gains in 2017 had been reversed to losses.

Objective for 2019: Increase REITs by 10% (Trying this again, hope to have good bargains), increase portfolio yield by 0.5%, increase income to $16,800 (or $1,400/month).

Lifetime accumulated dividends and interest, net of losses, excluding portfolio valuation gain/loss = $65,000

I am also sticking to my slow and steady turtle income "methodology": Assuming that I continuously invest $36,000/year or $3,000/month,

In 2 years, accumulated dividends and interest = $100,000, $1,600/month

In 6 years, accumulated dividends and interest = $200,000, $2,200/month

In 9 years, accumulated dividends and interest = $300,000, $2,700/month

It may seem slow, sticking to $3,000/month for 10 years without factoring any increases, but I prefer the approach of buying on dips, which may not be the most optimal thing to do, but I feel that it helps to make my stock acquisitions dividend accretive (portfolio cost price wise). If there is a big market correction or flash crash then I will likely activate my warchest.

I am writing this earlier this year as the total amount should be more or less the same by year end. Objective for 2018: Increase REITs by 10%, increase portfolio yield by 0.5%, increase income to $14,000.

Verdict: Didn't meet, didn't meet, meet.

Average dividend yield in 2017 was 4.56%. I didn't meet my target, and my average yield was 4.73% this year. This was achieved by buying stocks with >5% yield to increase the average, but it got pulled down by other non-performing stocks that cut dividends. In 2017, the plan was to support the increase by increasing REITs to 50% of my portfolio, starting from REIT ratio of 23% in 2017, and slowly rebalancing and capital injection at the right prices over 3 years, from 23% -> 33% -> 43% -> 50%. I did not buy that many REITs. In fact, I bought Singtel instead because yields were more attractive than REIT yields.

In order to further increase the average yield by another 0.5% will not be as easy as it will require buying stocks with >6% yield to increase the average. I may want to increase the growth stocks proportion, but I will see how prices are next year.

Income was $15,500 ($1,290/month), so I exceeded the target of $14,000. The additional increase was due to better dividends and also high bank interest rates from Bank of China 2.75%, UOB One 2.43%, Hong Leong Finance 1.7%, CIMB Fastsaver 1%, Singapore Savings Bonds 1.8%.

I didn't increase my Autowealth portfolio much as I found the prices too eratic. I will continue to contribute $400/month after the prices reverse closer to the mean. After an insane annualised yield of 15% in 2017, in 2018, the returns are a mere 4%, and could have been lower if I had continued to contribute as prices escalated 2% per month only to watch a big fall a few months later.

Unrealised profits/losses:

Autowealth = S$50 (+$260 in 2017)

Singapore Stocks = -$20,000 (+$20,000 in 2017)

Overall, gains in 2017 had been reversed to losses.

Objective for 2019: Increase REITs by 10% (Trying this again, hope to have good bargains), increase portfolio yield by 0.5%, increase income to $16,800 (or $1,400/month).

|

| Chart of humble beginnings |

I am also sticking to my slow and steady turtle income "methodology": Assuming that I continuously invest $36,000/year or $3,000/month,

In 2 years, accumulated dividends and interest = $100,000, $1,600/month

In 6 years, accumulated dividends and interest = $200,000, $2,200/month

In 9 years, accumulated dividends and interest = $300,000, $2,700/month

It may seem slow, sticking to $3,000/month for 10 years without factoring any increases, but I prefer the approach of buying on dips, which may not be the most optimal thing to do, but I feel that it helps to make my stock acquisitions dividend accretive (portfolio cost price wise). If there is a big market correction or flash crash then I will likely activate my warchest.

Monday, October 29, 2018

Stock Review: ISOteam

ISOteam Limited is a company that started out as painter that diversified its business over the years. It is Nippon Paint’s exclusive applicator of paint works for Repairs and Redecoration (R&R) projects for the HDB and Town Council segments, likely through its joint venture subsidiary TMS Alliances Pte Ltd.

The share price for this company had recently fallen a lot, because of fewer projects, reduction in suppliers' rebates (hence increased cost of sales) and increase in marketing expenses that ate into profits.

Business Model

65% of revenue comes from R&R and Additions and Alterations (A&A), which are rather labour-intensive. It's one of those things like a hair cut where you need hair cuts regularly and it can't exactly be automated. For hair cuts, the demand scales proportionally to the population. For R&R and A&A services, the demand scales with the number of buildings, which is correlated with the population and number of businesses. From this aspect, we can expect these services to remain in demand. Barrier to entry isn't high, but due to the labour-intensive nature of these services, new entrants will likely be smaller scale sub-contractors instead.

Nature of Expenses

As they spent $13M on their new corporate office in FY2017, the loans and depreciation expenses have just kicked in in FY18. Personally, I think that centralisation is good, considering that they had acquired many companies in the past few years and they likely had not consolidated their systems and manpower. Whether or not they can integrate everything together fast enough to control their expenses, I do not know, but the expenses do look prudent.

Net profit margin dropped to 0.9% in FY2018. I like it that this number was calculated and presented in the slides. Some companies that want to down play the decrease in net profit margin leave it to you to calculate it from the financial statements and just show you the gross profit margin. It will be good if they had stated how many years they used to depreciate their new leasehold property. It is also unknown if there are any old office premise currently parked under property assets that they will be selling away after they shift to their new office.

Earnings

Earnings per share is 0.66 cents. Dividend is 0.18 cents. Based on the last transacted price of 24 cents, it translates to Price Earning Ratio (PER) of 36 and Yield or 0.75%. This is awfully low and further price drops should be expected. The number of projects need to increase, or expenses reduced, in order for them to reap profits again.

References:

The writer owns shares in Isoteam.

The share price for this company had recently fallen a lot, because of fewer projects, reduction in suppliers' rebates (hence increased cost of sales) and increase in marketing expenses that ate into profits.

|

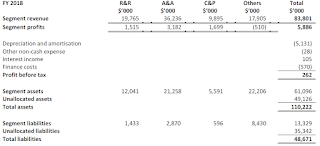

| Extracted from presentation slides from 4Q2018, ending 30 Jun 2018 |

65% of revenue comes from R&R and Additions and Alterations (A&A), which are rather labour-intensive. It's one of those things like a hair cut where you need hair cuts regularly and it can't exactly be automated. For hair cuts, the demand scales proportionally to the population. For R&R and A&A services, the demand scales with the number of buildings, which is correlated with the population and number of businesses. From this aspect, we can expect these services to remain in demand. Barrier to entry isn't high, but due to the labour-intensive nature of these services, new entrants will likely be smaller scale sub-contractors instead.

Nature of Expenses

As they spent $13M on their new corporate office in FY2017, the loans and depreciation expenses have just kicked in in FY18. Personally, I think that centralisation is good, considering that they had acquired many companies in the past few years and they likely had not consolidated their systems and manpower. Whether or not they can integrate everything together fast enough to control their expenses, I do not know, but the expenses do look prudent.

Net profit margin dropped to 0.9% in FY2018. I like it that this number was calculated and presented in the slides. Some companies that want to down play the decrease in net profit margin leave it to you to calculate it from the financial statements and just show you the gross profit margin. It will be good if they had stated how many years they used to depreciate their new leasehold property. It is also unknown if there are any old office premise currently parked under property assets that they will be selling away after they shift to their new office.

|

| Extracted from financial report from 4Q2018, ending 30 Jun 2018, page 27 of 29 |

|

| Extracted from financial report from 4Q2017, ending 30 Jun 2017, page 27 of 29 |

Earnings

Earnings per share is 0.66 cents. Dividend is 0.18 cents. Based on the last transacted price of 24 cents, it translates to Price Earning Ratio (PER) of 36 and Yield or 0.75%. This is awfully low and further price drops should be expected. The number of projects need to increase, or expenses reduced, in order for them to reap profits again.

References:

The writer owns shares in Isoteam.

Sunday, October 28, 2018

Book Review: Wee Cho Yaw - 黄祖耀 - 大华之道

I like the chinese title a lot more than the english title because it really reflects the contents of the book - the way of United Overseas Bank (UOB). The english title is Wee Cho Yaw - Banker, Entrepreneur and Community Leader by Pang Cheng Lian, which doesn't do justice to the book.

This book was recommended by a colleague. I was hooked onto the contents and finished reading the book within 1 man day spread over a few days. It is about the history of Wee Cho Yaw's life and some of the key business decisions that he made which made UOB what it is today. Compared with Robert Kuok's book, this book is much thinner, nothing about the war and japanese occupation, but it does show how common it was for men to have two wives in the past, how lucky they were, how their parents shaped their values (for Kuok, it was his mother, for Wee, it was his father), and how the leader' values run through the company.

Similar to Robert Kuok, Wee was also born with a silver spoon. Wee took over the bank from his father, Datuk Wee Kheng Chiang.

One thing that was mentioned multiple times was how important it was for the company staff to be focused on long term growth and results as opposed to short term results. He thinks that banks that reward staff based on annual profits and growth figures will lead staff to take on very high risks which puts the bank in an unnecessary risk position, such as loans to high risk customers, buying highly leveraged risky products, leveraged trades, etc. He claimed to reward staff more based on long term results, and as a result have many staff work for him for a very long time. He also emphasised the importance to have good leaders, and personally selects the leaders with the key characteristics of integrity to safeguard public funds and passion for the job. It sounds noble, and I really hope UOB remains like that.

Risk management in UOB is likely very conservative, given the way he describes that it is very important to win the trust of the customers, because the customers need to trust the bank in order for the bank to survive. He cited an example how a mini bank-run caused panic among the customers and staff even had to go as far as to escort a lady who withdrew tens of thousands of cash all the way to her home. The panic was caused by a misunderstanding where queues that formed at branches to pay their utilities bills was mistaken to be customers withdrawing their money. These rumours made other customers panic and when the bank branch ran out of cash, it caused even more panic to the public. It is always such experiences that live in the back of our minds that remind us the importance of building trust.

Wee also emphasised the need on passing on the values of the earlier migrant chinese and UOB, which was the motivation for this book. The migrant chinese placed a lot of emphasis of education, many contributed and continue to contribute to school building funds. Social cohesion through clans and associations were also something mainstream in the past, but not so much now because their roles had been taken over by structured education systems managed by the government. I wonder how much of chinese migrant history we can preserve when everything is so westernised.

The final chapter was one that made me reflect the more about what it means to "enjoy my job". Wee believes that to gain success, one must enjoy one's job. "The job is not important. What is important is that you enjoy doing it. You have to be passionate about your career; this is the basis of future success." However, the definition of success varies for everyone too.

He also prefers to employ people who are prepared to disagree with him when a situation warrants it. Although he is a person of strong views, the last thing he wants are yes-man who accept his ideas mindlessly. This also made me think about how the management hierarchy seem to favour yes-man nowadays.

His secret to success was summarised as luck, having the right team, and family support.

This book was recommended by a colleague. I was hooked onto the contents and finished reading the book within 1 man day spread over a few days. It is about the history of Wee Cho Yaw's life and some of the key business decisions that he made which made UOB what it is today. Compared with Robert Kuok's book, this book is much thinner, nothing about the war and japanese occupation, but it does show how common it was for men to have two wives in the past, how lucky they were, how their parents shaped their values (for Kuok, it was his mother, for Wee, it was his father), and how the leader' values run through the company.

Similar to Robert Kuok, Wee was also born with a silver spoon. Wee took over the bank from his father, Datuk Wee Kheng Chiang.

One thing that was mentioned multiple times was how important it was for the company staff to be focused on long term growth and results as opposed to short term results. He thinks that banks that reward staff based on annual profits and growth figures will lead staff to take on very high risks which puts the bank in an unnecessary risk position, such as loans to high risk customers, buying highly leveraged risky products, leveraged trades, etc. He claimed to reward staff more based on long term results, and as a result have many staff work for him for a very long time. He also emphasised the importance to have good leaders, and personally selects the leaders with the key characteristics of integrity to safeguard public funds and passion for the job. It sounds noble, and I really hope UOB remains like that.

Risk management in UOB is likely very conservative, given the way he describes that it is very important to win the trust of the customers, because the customers need to trust the bank in order for the bank to survive. He cited an example how a mini bank-run caused panic among the customers and staff even had to go as far as to escort a lady who withdrew tens of thousands of cash all the way to her home. The panic was caused by a misunderstanding where queues that formed at branches to pay their utilities bills was mistaken to be customers withdrawing their money. These rumours made other customers panic and when the bank branch ran out of cash, it caused even more panic to the public. It is always such experiences that live in the back of our minds that remind us the importance of building trust.

Wee also emphasised the need on passing on the values of the earlier migrant chinese and UOB, which was the motivation for this book. The migrant chinese placed a lot of emphasis of education, many contributed and continue to contribute to school building funds. Social cohesion through clans and associations were also something mainstream in the past, but not so much now because their roles had been taken over by structured education systems managed by the government. I wonder how much of chinese migrant history we can preserve when everything is so westernised.

The final chapter was one that made me reflect the more about what it means to "enjoy my job". Wee believes that to gain success, one must enjoy one's job. "The job is not important. What is important is that you enjoy doing it. You have to be passionate about your career; this is the basis of future success." However, the definition of success varies for everyone too.

He also prefers to employ people who are prepared to disagree with him when a situation warrants it. Although he is a person of strong views, the last thing he wants are yes-man who accept his ideas mindlessly. This also made me think about how the management hierarchy seem to favour yes-man nowadays.

His secret to success was summarised as luck, having the right team, and family support.

Tuesday, October 16, 2018

What did I buy in Aug 18, Sep 18 and Oct 18?

Gosh, 3 months zoomed past!

Aug 18

Isoteam Bought Isoteam at $0.31 without a detailed review. Prices have fallen further since (0.215 on 15 Oct), so I probably should stop procrastinating and do a proper review.

Sep 18

QAF Bought more at $0.75. Prices have fallen further since (0.725 on 11 Oct). Somehow I don't seem to be hitting the right notes although I did a detailed review in July.

Oct 18

None so far... but I am watching Capitaland Commercial Trust, SIA Engineering, Wilmar... I will probably end up putting my money in Singapore Savings Bonds temporarily as I haven't found anything really worth buying.

[Edit: bought AIMS AMP REIT in end Oct]

Aug 18

Isoteam Bought Isoteam at $0.31 without a detailed review. Prices have fallen further since (0.215 on 15 Oct), so I probably should stop procrastinating and do a proper review.

Sep 18

QAF Bought more at $0.75. Prices have fallen further since (0.725 on 11 Oct). Somehow I don't seem to be hitting the right notes although I did a detailed review in July.

Oct 18

None so far... but I am watching Capitaland Commercial Trust, SIA Engineering, Wilmar... I will probably end up putting my money in Singapore Savings Bonds temporarily as I haven't found anything really worth buying.

[Edit: bought AIMS AMP REIT in end Oct]

Sunday, August 19, 2018

Stock Review: Singapore Airlines

I last reviewed SIA in Feb 2017. Prices have since went on a roller coaster ride and it's now $9.56, last done last friday. The lowest was $9.50 on 13 and 16 Aug 2018.

Profit Margin

Profit Margin is still lean, but an improvement from previous review,

FY17 = 892.9/15806.1=5.65%

FY16 = 360.4/14868.5=2.42%

Q12018 = 149/3844.5=3.88%

Q12017 = 346.5/3864.2=8.97%

Fuel costs have been rising and adding to costs. In 2016 and 2017, fuel costs form 25% of revenue.

FY17 = 3899.3/15806=24.7%

FY16 =3747.5/14868.5=25.2%

Q12018 = 1079.4/3844.5=28.1%

Q12017 = 925.7/3864.2=24.0%

Clearly, fuel costs ate into their margins in Q12018.

Return on Assets (= Net Income/Assets)

SIA is constantly buying aircraft. They boast a young fleet with average age under 5 years old. I chose to divide by the Property, Plant and Equipment figure as it is likely referring to the aircraft, instead of total assets, which includes other investments. For this calculation, I prefer to use the more conservative net income instead of operating profit because debt is used to finance the aircraft purchase.

FY17 = 892.9/19824.6=4.5%

FY16 = 360.4/16433.3=2.2%

Overall, it's still not an effective use of the aircraft, but I guess we can say that the new aircraft may be a draw for customers.

Dividend Sustainability

Free Cash Flow per share is even more negative now at -$1.03 in Q12018. Dividend payouts are funded by debt. Although they paid a dividend of 40 cents for 2017, a yield of 4.2%, I am not attracted to it. As a whole, SIA may have been watching their costs, but I just don't think their increasing debt is a good thing.

The writer does not own any SIA shares.

References:

Profit Margin

Profit Margin is still lean, but an improvement from previous review,

FY17 = 892.9/15806.1=5.65%

FY16 = 360.4/14868.5=2.42%

Q12018 = 149/3844.5=3.88%

Q12017 = 346.5/3864.2=8.97%

Fuel costs have been rising and adding to costs. In 2016 and 2017, fuel costs form 25% of revenue.

FY17 = 3899.3/15806=24.7%

FY16 =3747.5/14868.5=25.2%

Q12018 = 1079.4/3844.5=28.1%

Q12017 = 925.7/3864.2=24.0%

Clearly, fuel costs ate into their margins in Q12018.

Return on Assets (= Net Income/Assets)

SIA is constantly buying aircraft. They boast a young fleet with average age under 5 years old. I chose to divide by the Property, Plant and Equipment figure as it is likely referring to the aircraft, instead of total assets, which includes other investments. For this calculation, I prefer to use the more conservative net income instead of operating profit because debt is used to finance the aircraft purchase.

FY17 = 892.9/19824.6=4.5%

FY16 = 360.4/16433.3=2.2%

Overall, it's still not an effective use of the aircraft, but I guess we can say that the new aircraft may be a draw for customers.

Dividend Sustainability

Free Cash Flow per share is even more negative now at -$1.03 in Q12018. Dividend payouts are funded by debt. Although they paid a dividend of 40 cents for 2017, a yield of 4.2%, I am not attracted to it. As a whole, SIA may have been watching their costs, but I just don't think their increasing debt is a good thing.

The writer does not own any SIA shares.

References:

- Financial Report Q12018, ended 30 Jun 2018

- Financial Report Q42017, ended 31 Mar 2018

Monday, July 30, 2018

What did I buy and sell in Jul 18?

QAF Limited Bought more at $0.86. I systematically bought after prices fell another 10%. This time, I did a more detailed review on the business and the factors affecting their pork business. I still believe that it is a good business although I have heard many alternate interpretations. It is one of those moments where you wonder if your analysis is wrong because everybody is selling, or the opposite...

Singapore Press Holdings (SPH) Sold at $2.90. I recommended to buy SPH when the prices fell after the next CEO took over. I recently decided to sell because it has risen 20% from it's low of $2.41 (23 Mar 2018). One of my sell criteria is when the price rises fast without any fundamental or economic changes that caused the prices to fall. Most importantly, it's to take profit first, then decide whether to by again later. Given the share price's volatility, this stock should be a good candidate to trade in and out. There should be another wave to ride when SPH launches their Woodleigh Residences condo in late Sep 2018. I will see how the prices go...

Singapore Press Holdings (SPH) Sold at $2.90. I recommended to buy SPH when the prices fell after the next CEO took over. I recently decided to sell because it has risen 20% from it's low of $2.41 (23 Mar 2018). One of my sell criteria is when the price rises fast without any fundamental or economic changes that caused the prices to fall. Most importantly, it's to take profit first, then decide whether to by again later. Given the share price's volatility, this stock should be a good candidate to trade in and out. There should be another wave to ride when SPH launches their Woodleigh Residences condo in late Sep 2018. I will see how the prices go...

Subscribe to:

Posts (Atom)